Payday loans online

Interest Rate (p.a.)

34.30%

Loan Tenure

6 months

Approval Duration

Up to 7 working days

Min. monthly income

R500

Flexible, short-term loans that give you back control.

Wonga- Quick Payday loan SA

Wonga is currently considered a particularly popular payday loan service provider in South Africa. The company offers its customers 24/7 access to quick and easy loans. Once approved, the loans are paid into their bank account on the same day of their application, in most cases. Payday loans like Wonga offer a convenient way for customers to gain access to smaller amounts of money. This is beneficial compared to personal loans. Payday loans are great for cases where the customer is struggling to make ends meet during the month.

Wonga has flexible terms and offers a full control panel where the customer can manage their account at any time. Customers are also given instant access to a new payday loan once their existing loan has been paid off. In addition to providing payday loans, the company has recently also decided to extend the period during which the customer can pay off their loan – customers can now choose terms of up to six months. Customers with a bad credit record are welcomed at Wonga. It is important to note, however, that the company does not provide any no credit check loan options. Approval of a loan is subject to a credit check.

Quick Decision Payday Loan

Wonga payday loans are convenient because the company has implemented a system that makes it exceptionally easy for the customer to complete an application. Additionally, the system uses the latest technology in order to connect directly to the biggest credit bureaus in South Africa. What this means for the customer submitting an application for a loan is that a credit check can be done 24/7.

The system completes a credit check on the details submitted by the customer. A decision will be available instantly after the credit check. Customers who are pre-approved for a loan will be able to complete their application. Some documents also need to be submitted through the online portal.

With Wonga online payday loans, customers are not required to drive to the office of the loan provider. The company has developed its system in such a way that everything can be done on the internet – from the comfort of the customer's own home, or office, or even while they are on-the-go. This makes the process faster and much less convenient, compared to having to make a lengthy visit to an office.

How To Apply For A Wonga Payday Loan

Wonga payday loans South Africa have a unique website that was developed in order to provide each customer with a quick, easy, and effortless application experience. To apply, a customer needs to start by visiting the official South African website of the Wonga company.

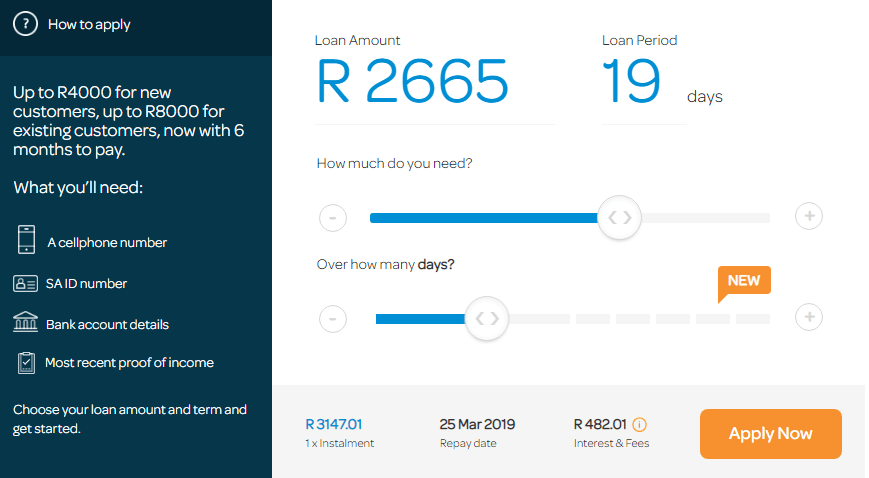

The website’s homepage features a quick application form. The customer can select the specific amount that they would like to borrow – this can range from R500 up to R4000 for new customers. Existing customers are sometimes given access to larger amounts, depending on their relationship with the company.

The next step is to choose the loan period. The minimum loan period is four days. The maximum loan period is six months. The customer should choose an adequate loan repayment period based on the availability of money on their side.

The final step is to complete the application form. This includes filling out a form with the customer’s personal details, along with their identity number, employment details, and financial information. The system will then run a credit check to see if the customer qualifies for a loan.

Direct Lender Payday Loan

A significant benefit that Wonga has over many alternative services that provide payday loans is the fact that they are not a broker, but rather a direct lender. What this means is that the company will not collect the customer’s details and submit their information to a third-party lender in order to determine if the customer is eligible for a payday loan.

Instead, Wonga is a fully registered loan provider that gives out loans directly, without the involvement of third-party lenders. When a customer applies for a payday loan at Wonga, their information will only be collected by the company and will not be shared by third-party service providers.

Loans are also paid out much faster compared to applying for a payday loan at a broker. When applying at a broker, the customer will have to wait for the broker to obtain approval on their application from the lender. When Wonga approves a customer’s application, they pay out the money directly to the customer – often times within the same day of the customer’s payday loan application.

Safe Service

Wonga is also committed to the security of the customer’s data. As noted previously, the company is a direct lender and information shared by the customer will not be provided to a third-party service provider, apart from the customer’s credit record being requested from a credit bureau.

In addition to not submitting the customer’s confidential information to third-party companies, Wonga has also taken appropriate measures to ensure the safety of the data stored on their database. They use state-of-the-art online security systems to protect their databases against breaches, ensuring no information about their customers is leaked.

The official Wonga website is also equipped with a valid SSL certificate. This helps to provide an extra layer of security for the data that a customer submits on their website during the application process.

Criticism And Other Credit Services Like Wonga

One of the major concerns that customers have noted about Wonga’s payday loan services is the high fees that are charged on loans initiated by the company. Customers are expected to pay initiation fees that may go as high as R534.75. Service fees charged on an R4000 loan paid off over a six-month period is R441.60. This means the calculate fees that are added to a payday loan would be R976.35 – this does not even include interest fees charged on loan – in the case of the R4000 loan, interest added to the loan will calculate to R548.65.

There are alternative options that customers can opt for, of course, sometimes offering lower interest rates and fees. Some popular instant payday loans like Wonga would include Wanna Loan and Little loans.