Online Payday Loans in South Africa

Interest Rate (p.a.)

14.50%

Loan Tenure

34 days

Approval Duration

Up to 7 working days

Min. monthly income

R1,000

Express Finance - Payday Loan Online

Express Finance is a payday loan service provider that is fully registered with the NCR to provide customers with short term financial services. The company has been providing customers in South Africa with payday loans for multiple years and have become a trusted provider amongst many citizens.

One of the major benefits that Express Finance is able to offer over alternative payday loan providers in the country is their low admin and initiation fees, leading to a lower repayment amount when compared to some of the leading financial service providers in South Africa. Customers are able to quickly apply for a loan on the official Express Finance loans website and the company usually processed the application within the same day, given that the customer applies on a weekday and not during a weekend.

The application process is fairly simple, and the company offers new customers access to discounted fees. Government employees are also provided with reduced initiation fees and admin fees. Furthermore, Express Finance offers a transparent service – there are no hidden fees added to loans, as all repayment fees are clearly stated on the loan contract when the customer signs the agreement.

How To Apply For A Loan?

Applying for a payday loan at Express Finance is quick and easy. Customers are able to visit their website 24/7 and submit an application, but it should be noted that applications are only processed during the company’s specified business hours.

Their business hours are as follow:

- Monday to Thursday: 8 am to 4 pm

- Friday: 8 am to 3 pm

- Saturday: 8 am to 10 am

Any applications that are made outside of these times will be processed on the next business day.

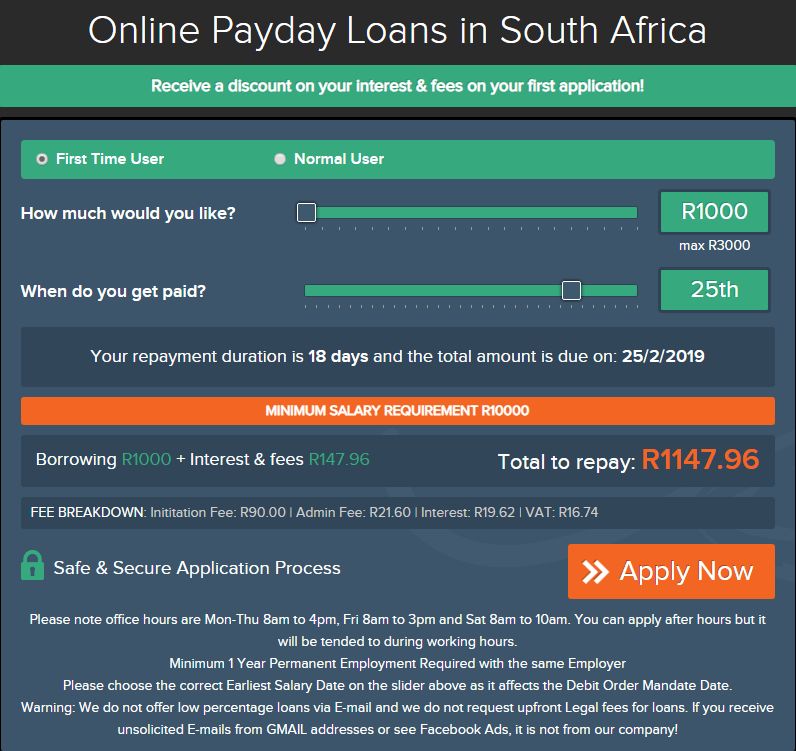

Once a customer lands on the official Express Finance loans and investments website, they can use two sliders in order to specify their requirements. The customer needs to choose the amount for the payday loan, as well as the loan period. Once these have been selected, an overview of the fees and total amount repayable will be presented to the customer.

If the customer is happy with the terms, they can initiate the application and complete the appropriate process. The customer will need to enter their personal details, along with their income and employment information. Banking details are also needed in order to set up a debit order on the customer’s account.

Express Finance Helps You Get A Loan

Express Finance is able to help new customers with a loan amount between R1000 and R3000. The customer will also be able to choose the loan period, based on when their next payday is. Loans can be taken out over periods ranging from one day up to 31 days. The customer is requested to choose their next salary date during the application process.

It should be noted that there are some specific requirements that the customer will need to meet to qualify for a payday loan at Express Finance. This includes permanent employment for a minimum period of one year, as well as a minimum salary of R10000 per month.