SOUTH AFRICA’S LEADING NAME IN ONLINE, PAYDAY LOANS. FOR FAST, PAPERLESS CASH LOANS UNTIL PAYDAY!

Interest Rate (p.a.)

15.00% - 52.00%

Loan Tenure

5 - 37 days

Approval Duration

Up to 7 working days

Min. monthly income

R3,000

Wanna Loan Payday Loans online SA

Wanna Loan is one of the few payday loan service providers in South Africa that are able to give customers a true paperless experience when it comes to lending money online.

The website developed with appropriate services to ensure all the necessary checks can be done without the need for additional documentation on the customer’s side. This holds a significant benefit over many competitor payday loan services out there, as customers are usually requested to submit a number of documents, including copies of their identity card, bank statements, and payslips before final approval can be provided.

Wanna Loan aims to provide customers with same-day payouts, in most cases. This means customers access the funds they require on the same day that they apply for the payday loan at this company.

The company is currently offering new customers the ability to apply for amounts between R500 and R3000. Customers should carefully consider how much they require, however, as larger amounts, coupled with a longer loan term, leads to higher fees.

Our Promise

- We will always deliver a high standard of service

- We will be fair and transparent in our business practices

- We will continuously develop and improve our model so that South Africans can access short-term credit for their everyday needs.

- We will always reinvest in our company to ensure growth and best returns for all our clients.

- We will always strive to champion the customer experience.

How To Apply For A Loan

Wanna Loan has an advanced system that was developed to provide customers with 24/7 access to an online payday service. The company’s website connects directly the appropriate credit bureaus in South Africa to request details of a customer’s credit history in order to determine whether or not the customer is eligible for a payday loan.

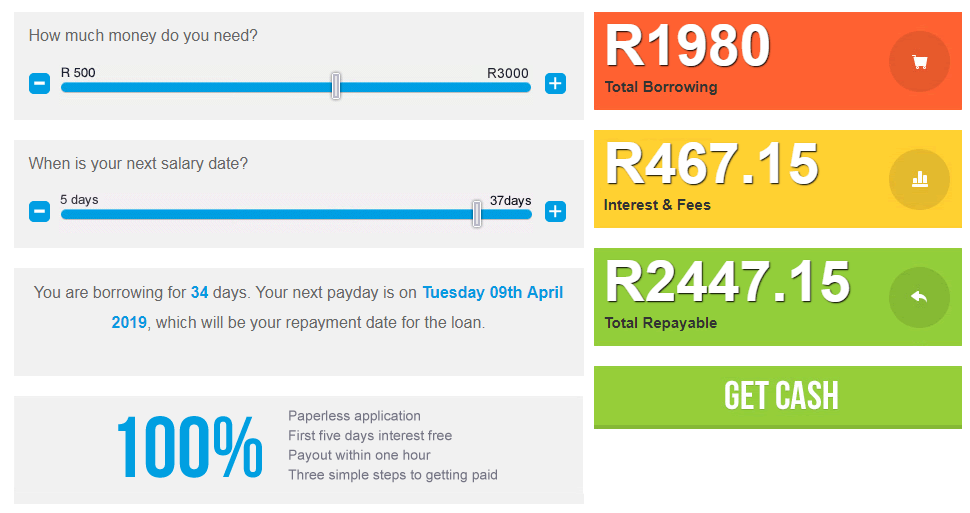

Customers who are interested in applying for a quick loan with the Wanna Loan payday loan provider should visit their website. The homepage of their website contains two sliders that customers can use to select how much money they would like to borrow, as well as how long they would like to borrow the money for.

There are three boxes on the side of the sliders that provide the customer with information on how much they are going to be paid, how much interest and fees will be added to their loan, and how much money they will need to pay back at the end of the loan period.

If the customer is happy with these terms, they can simply click on the “Get Cash” button and then follow the simple steps to complete their application.

Bad Credit History, This Is Not A Problem At Wanna Loan

One factor that sets Wanna Loan apart from a lot of the competitor payday loan service providers in South Africa is the fact that the company is known to assist many customers who have bad credit records. This is a common problem among the South African population, and the majority of financial service providers in the country usually turn people away when they have a poor credit history.

While a comprehensive credit check is still performed on each customer that applies for a loan at Wanna Loan, the company is less strict with their checks and are more likely to approve a loan than some of the other payday loan providers.