Bring a smile to your dial with a Boodle quick loan!

Interest Rate (p.a.)

Interest Rate: 0.17% per day. Annual Interest Rate (APR): 60%.

Loan Tenure

Up to 32 days

Approval Duration

Our easy online application process usually takes under 10 minutes from start to finish.

Min. monthly income

No requirements defined

About Boodle Loans

Boodle loans are short term loan solutions for online borrowers in South Africa. Online loans are an easy way to access emergency cash and Boodle finance makes this a dream come true. A quick search online and you will realize that there are several lending platforms online besides Boodle. So, what makes it stand out?

What Type of Loans does Boodle Offer?

Boodle loans offer the following loans to its customers:

Boodle loans offer the following loans to its customers:

- Payday loans;

- Short-term loans;

- Personal loans;

- Unsecured loans;

- Same-day loans.

Why choose Boodle loans?

Boodle instant loans have a credible track record over the years it’s been in business. It allows lenders to evade exhaustive traditional borrowing systems by issuing at easy Boodle loans.

· Quick Access to Cash

Boodle finance awards loans almost instantly to borrowers on its site. Emergency lending allows the customers to access better borrowing alternatives in tough economic times by getting rid of the paperwork and the long queues at the bank. Funds will be sent to your account straight away after a speedy review of your application.

· Repayment Terms

Boodle loans have flexible repayment terms in place that allow borrowers to pay back the loans without straining their pockets. Boodle reviews online support this fact and create confidence in the clients. No surprises and no hidden fees or transactions that will exaggerate the loan amount due during the repayment period.

· Mobile Application

Online application processes through the websites or the mobile versions of Boodle finance are a quick and easy alternative to apply for cash straight from the palm of your hand.

· Reliable Customer Care Services

Boodle loans have a customer care desk online in case of any discrepancies with the loans disbursed or the repayment terms. Boodle loans contact details are available and the customer service platform can be contacted any time of the day.

· No Paperwork

Online loan application processes have become popular. Why? Customers need only fill their details and the loan amount they need. Soon after, the loan is disbursed almost instantly to their accounts.

· Flexible Repayment Periods

Boodle loans allow you to pay back your loan within a span 2 days to 32 days depending on the amount of money that you received.

How do Boodle Loans Work?

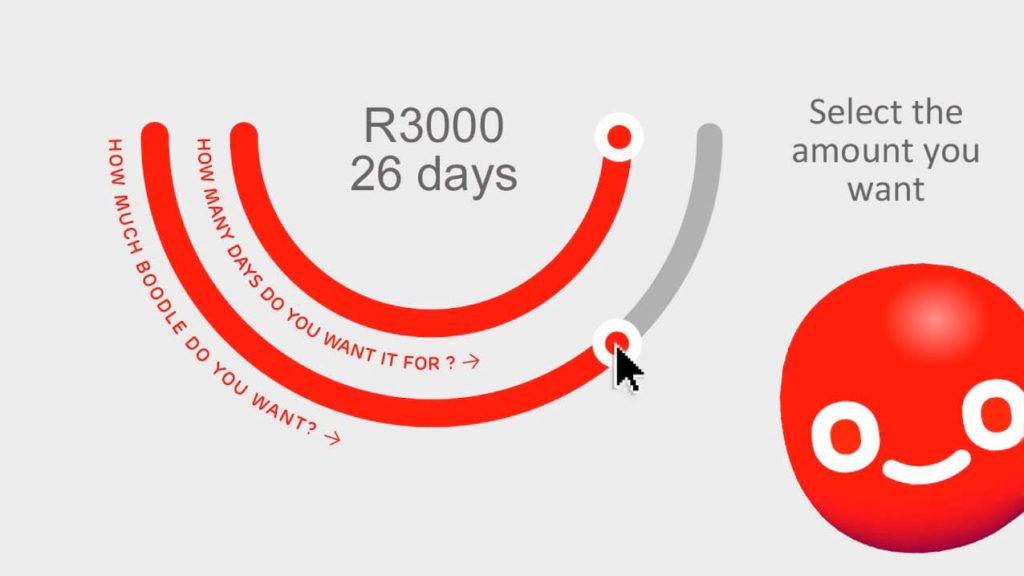

Boodle login into the website in South Africa is the first step. The loan application procedure is very easy. Use your computer or your smart-phone to access the boodle loans company site and choose the amount of money you want to borrow. You will then be prompted to fill out and submit your details in the loan application section.

Once the system receives the application, credit history is checked. Depending on your credit score, you will receive a loan offer which is then wired to your bank account immediately. Please note that the company does not offer Boodle loans to blacklisted borrowers.

How Boodle Helps You?

Boodle finance comes in to meet any financial needs you might have before the end of the month. While there is an option of borrowing from your bank, the process is an uphill task. Boodle money allows you to access short-term loans and other types of loans with flexible repayment plans and reasonable repayment periods.